Complaints

Te Whakatakoto Whakapae

Making a Complaint

Te Whakatakoto Whakapae

How to make a complaint

Your rights when making a complaint

When you make a formal complaint under the Fair Insurance Code, your insurance company will:

- acknowledge receipt of your complaint within five (5) business days

- respond to your complaint within 10 business days

- advise you of your right to take your complaint to their independent external dispute resolution scheme if they are unable to resolve your complaint within two (2) months.

External dispute resolution schemes

Any insurer who provides their services to retail customers must belong to an approved external dispute resolution scheme under the Financial Services Providers (Registration and Dispute Resolution) Act 2008.

External dispute resolution schemes are free to the insurer’s customers but do have some limits on what types of complaints they can consider. For instance, they cannot review complaints relating to commercial decisions (such as premium or policy terms) or where the amount in dispute is greater than $350,000 (plus GST if applicable). Disputes greater than these amounts will need to be heard in either the District or High Court.

External dispute resolution schemes investigate complaints and try to resolve them by negotiation or mediation, where possible. They are approved by the Minister of Consumer Affairs under this Act and must be:

- independent

- fair

- accessible

- accountable

- efficient

- effective.

Your insurer will belong to one of two approved dispute resolution schemes:

ICNZ's Code Compliance Committee

If the Committee agree that there has been a significant breach that has brought the industry into disrepute, they will report the breach to the Board of ICNZ and recommend a sanction to be applied. The ICNZ Board then makes the final decision about whether a sanction should be applied. The ICNZ Board is able to reprimand members, terminate their membership, or impose a fine of up to $100,000. Any fine money is used by ICNZ to pursue financial capability programmes for the public.

The Code Compliance Committee is currently made up of the following independent members:

- Dr Warren Young QSO – Principal Operations Adviser, Independent Police Conduct Authority.

- Hon David Caygill – former Minister of Finance, partner at Buddle Findlay, and Commissioner of Environment Canterbury.

- Diane Morcom CNZM – former Secretary of the Cabinet and Clerk of the Executive Council.

The Compliance Committee is chaired by Tim Grafton (ICNZ CE).

Complaints data

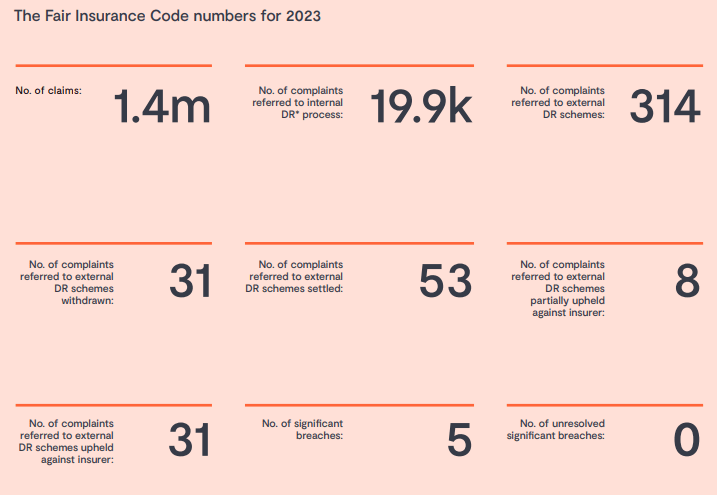

ICNZ has long collected and published Fair Insurance Code complaints data in its Annual Review. The summary below is for the 2023 calendar year.

Detailed reporting of personal complaints

The table below contains data by insurer relating to personal lines complaints. These include house, contents, motor, marine, travel and credit insurance taken out by individuals where a decision has been made by the external dispute resolution schemes; the Insurance and Financial Services Ombudsman Scheme (IFSO) and Financial Services Complaints Limited (FSCL) – a Financial Ombudsman Service.

Of the 1.2m claims made each year, about 11,000 complaints are referred to the insurance companies internal dispute resolution processes. Most of these are resolved internally with only a small number referred to the external dispute resolution schemes. If referred to an external dispute resolution scheme, they will then investigate the complaint and make a decision either in favour of the customer or insurer, essentially confirming if they correct decision has been made.

How to read this table

The independent external dispute resolution services will investigate the complaint and then make a decision either in favour of the customer or the insurer, essentially confirming if the correct decision has been made. An agreed outcome may be reached where a decision cannot be found in favour of either the customer or insurer in full.

Every insurer has a different number of customers, claims and complaints. It is therefore important to take this into account when looking at the numbers. For example, it makes sense that the insurers with a larger market share will have more claims and therefore more complaints, and insurers with a smaller market share will tend to have fewer claims and complaints.

The summary below provides complaints data from the External Dispute Resolution Schemes.

| ICNZ member | Number of complaints closed over the period | Number of complaints upheld in the customer's favour | Number of complaints upheld in the insurer's favour | Number of complaints not completely upheld in either the customer's or insurer's favour | % Complaints share |

|---|---|---|---|---|---|

| AA Insurance Ltd | 10 | 0 | 9 | 1 | 7.0% |

| AIG Insurance NZ Ltd | 5 | 0 | 4 | 1 | 3.5% |

| Aioi Nissay Dowa Insurance Co Ltd | 2 | 0 | 1 | 1 | 1.4% |

| Allianz Australia Insurance Ltd† | 0 | 0 | 0 | 0 | 0.0% |

| Chubb Insurance NZ Ltd | 3 | 0 | 2 | 1 | 2.1% |

| FMG Insurance Ltd | 9 | 0 | 7 | 2 | 6.3% |

| Hallmark General Insurance Company Ltd† | 0 | 0 | 0 | 0 | 0.0% |

| The Hollard Insurance Company Pty Ltd | 20 | 2 | 14 | 4 | 14.0% |

| IAG NZ Ltd | 51 | 0 | 46 | 5 | 35.7% |

| Medical Insurance Society Ltd (MAS) | 1 | 1 | 0 | 0 | 0.7% |

| Provident Insurance Corporation Ltd | 1 | 0 | 1 | 0 | 0.7% |

| TOWER Ltd | 23 | 2 | 16 | 5 | 16.1% |

| Vero Insurance NZ Ltd | 14 | 0 | 13 | 1 | 9.8% |

| Zurich Australian Insurance Ltd | 4 | 0 | 4 | 0 | 2.8% |

| Total: | 143 | 5 | 117 | 21 | 100.0% |

Notes

† Companies that have a personal lines portfolio of less than 0.01%.

Lloyd’s data is not included in the table above as it is an insurance and reinsurance market, rather than an insurer. ICNZ does not hold data about Lloyd’s personal lines market share.

Definitions relating to data categories

- ICNZ member – the company who has been accepted into membership of the Insurance Council of New Zealand/Te Kāhui Inihua o Aotearoa.

- Complaints closed –A complaint or dispute that was investigated by the external dispute resolution scheme and a decision is made. It does not include complaint enquiries.

- Complaints upheld in the customer’s favour – The external dispute resolution scheme has investigated the claim and made a decision in favour of the customer.

- Complaints upheld in the insurer’s favour – The external dispute resolution scheme has investigated the claim and made a decision in favour of the insurer.

- Complaints not completely upheld in either the customer’s or the insurer’s favour – The external dispute resolution scheme has made a decision that has not found in either the customer or insurer’s favour and instead there was an agreed outcome. These are also known as settled, or partially upheld complaints.

- Percentage of complaints share – the percentage of complaints where an external dispute resolution scheme has made a decision.